Let’s talk about conversion rates (Lead to SQL vs MQL to SQL)

.jpg)

A question I’ve seen raised in a few of my favourite online networking groups is: “What is a good conversion rate for Lead to SQL vs. MQL to SQL?

Other ways to phrase:

- How does outbound (i.e. prospected lead) conversion compare to inbound (i.e. marketing generated) conversion?

- How does my outbound “hunter” sales performance compare to inbound? Which is better?

- What are good benchmarks and how do my conversion rates compare to other businesses in my industry?

If you’ve pondered any of the above then I hope you will find this blog of interest. I’d also like to challenge the us vs them mentality of most sales and marketing organisations. Inbound isn’t necessarily better than Outbound - even if the conversion rate will usually tell you so. Read on to see why.

PART 1: Define what you’re measuring - don’t over-egg the qualification pudding!

Part of what makes this such a hot topic in B2B is that even defining what constitutes a Lead, MQL or SQL can be a bit of a minefield and it varies greatly depending on who you’re speaking to.

Personally I feel that this question is far too often needlessly overcomplicated.

I take a very pragmatic and simplified approach. I believe it should all start with your Ideal Customer Profiles (ICPs) that collectively form your Total Addressable Market (TAM) - aka your target audience.

Simply put: if it is a company that you can sell to (and only if it is a company you can sell to) can you call it a lead in the first place. Too often I see contacts labelled as a lead because they’ve downloaded some content or used the contact us form. This is the wrong footing to be on. You cannot be a Lead, MQL, SQL, Opportunity or even a Customer unless you fit an ICP.

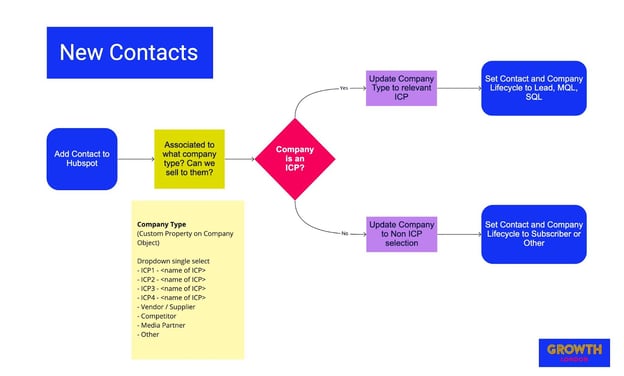

In other words you need to tie your target audience ICPs to the customer lifecycle stages. I’ve written more about this here.

An important note on the above model is that your ICPs should collectively constitute all of your target audience (TAM). A top tip is to review all past clients and current opportunities to ensure you have everything covered when defining your ICPs.

For any contact added to your CRM the first question should always be - Can we sell to them? Do they fit one of our ICPs? In other words what type of company does the contact work for? This is the fundamental triage system that I build and base much of my consulting around.

If the company / contact in question fits one of your pre-defined ICPs - then it is in essence pre-qualified to be one of the following:

- A Lead (a target audience contact not yet opted in - e.g. a prospected lead)

- A MQL (a target audience contact opted in via marketing efforts)

- A SQL (a target audience contact in early stage contact with sales team with expression of interest)

- An Opportunity (a target audience contact with a viable opportunity and buying signal e.g. a deal is created in the sales pipeline)

- A Customer (a target audience contact that has purchased)

And it follows that if the sales and marketing team cannot define which type of company a contact is associated with, e.g. whether or not the company is part of who you can sell to, then neither can they label the contact as any of the above.

To my mind the above simple framework solves a lot of the qualification mess and an added bonus is a much cleaner and better structured CRM.

So to belabour the point and be crystal clear:

- A lead is an ICP contact that has not yet opted in (e.g. OUTBOUND)

- A MQL is an ICP contact that has opted into your marketing (e.g. INBOUND)

- A SQL is an ICP contact that has expressed interest to your sales team

It’s not about nitpicking, it’s about accuracy when monitoring your conversion rates. If you’re going to establish a benchmark to measure how well your conversions into SQLs are doing, there’s no point in skewing the numbers by including contacts who were never going to reach a sales conversation in the first place.

PART 2: With ICP triage in place, you’re ready to set up your conversion reporting.

Now you can turn your attention to conversion rates between Lead to SQL vs MQL to SQL.

You’re going to want two key reports which are limited to only include ICP contacts. The reports are available in HubSpot’s report library so no need to create a custom report.

Where: Report library

Report Type: Funnels

Report name: “Contact lifecycle stage funnel with contact totals and conversion rates”

The reports are super easy to set up:

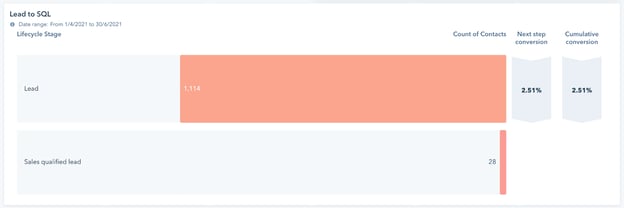

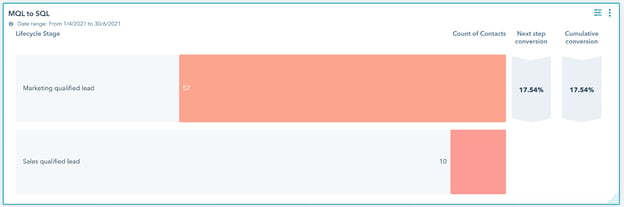

Create the first one with only the “Lead” and “Sales qualified lead” lifecycles and save it to your dashboard. Then create another with “Marketing qualified lead” and “Sales qualified lead” lifecycles.

You should now have 2 reports as follows:

a.) Lead to SQL conversion (this represents your Outbound sales)

b.) MQL to SQL conversion (this represents your Inbound)

BONUS TIP: filter the reports to only show ICP contacts. I really like to add this additional safeguard to drive home the importance of lead triage. I create an active contact list which only includes contacts that are associated with companies where Company Type = ICPs.. This way you can also tell marketing and sales teams that if they want their hard work to be included in leadership reporting they must ensure company type is added for all their data.

With your reports built and saved on a dashboard you can now filter by team, sales rep, time range etc.

PART 3: What do you do with this information? Tell a better story that brings marketing and sales together!

So now that you have reporting and you know it is likely to be more accurate because it is limited to only include data that has been clearly identified as belonging to your target audience, you have the means to see and compare conversion rates.

Here’s something interesting - the MQL to SQL conversion rate is ALWAYS higher. At least that is my experience in every HubSpot implementation I’ve worked on. This is to be expected right? Inbound leads that engage with your website and content and who complete a form on your website are almost always going to have a higher chance of conversion.

Which begs the question - if you know that MQL to SQL is almost certainly higher, WHY do you want to compare inbound to outbound?

My answer to the above is that it is not really relevant to compare between the reports - the main purpose is to drive home a point to your sales and marketing teams to work together.

BOTH should have the objective of generating MQLs.

Yes, you heard correctly. If you know that MQLs convert to SQLs at a higher rate, and you have the reporting to demonstrate this to your teams, then the simple learning is that your sales teams should also want to see an increase in MQLs. After all these are still passed to the sales team, who have a higher chance of creating an opportunity, and hence earning commission!

So sales teams, when prospecting and conducting cold outreach, should be incorporating sales collateral (created in conjunction with the marketing team) with the goal of getting the cold lead to opt in and become an MQL.

Isn’t it ironic that reporting that is in most cases used to compare outbound vs inbound so as to generate competition between sales and marketing can instead be used to help break down the silo?

Where the comparison should be is not BETWEEN reports - but rather individually on each report between time frames. E.g. you should be looking to increase or improve the conversion rate on each report independently. Move the needle here. And one way to do this is to get your sales team to work with marketing to generate more MQLs.

In conclusion

Whether a contact is a cold prospective lead that you’re reaching out to for the first time or they’ve engaged with your marketing, the first criteria they have to fit is your ICP. Unless they can do that, they’re never going to be a true lead – even if they’ve joined your mailing list, attended your webinars and downloaded every piece of content from your website. It’s their fit with your ICPs that makes the difference.

Your conversion reporting will be far more accurate and reliable if you have ICP/Lifecycle triage in place. It’s also easy to set these reports up in HubSpot, and you should absolutely do so.

But not because the goal of monitoring your conversion rates is to work out whether inbound or outbound is better. Likewise it shouldn’t be used to drive unhealthy competition between your marketing and sales teams. Instead, you should use it to pull everyone into alignment.

If the conversion rate from MQL to SQL is greater than from cold prospect to SQL (and it almost certainly is), that shouldn’t be disheartening for the sales team. On the contrary, it’s an opportunity.

Sales teams don’t need to stick to their silo, only celebrating the deals they’re 100% responsible for. They can help to generate MQLs, using marketing content when they reach out to prospects. After all, they’ve got a far higher chance of turning leads into deals (and therefore commission) if the marketing team has worked their magic first.

When sales and marketing work in synergy – supporting each other with insight, inspiration and resources – it’s a win-win. MQLs are a sales team’s best friend. And by monitoring the finer details of your conversion rates, your marketing team can better tailor their content to help leads of all kinds to convert – and eventually sign on the dotted line.

If you’re looking to start monitoring your lead and MQL conversion rates, check out my blog posts on correctly setting up your Lifecycle with ICPs and getting your CRM data reporting at the top of its game.

Footnote on benchmarking

You may have noticed that I made no mention of benchmarking conversion rates between companies and by industry. Simple reason is I think this is a fool's errand. Way, way too many variables at play for such data to be a reliable indicator of performance. I may be wrong in this assertion but I don’t think so. I think it is far better to get the reporting in order to create your own internal benchmark which you then try to improve over time.